Hello friends, welcome to Let Students See. So, we have already seen the basic concepts of a consignment, we have seen journal entries, we have seen valuation of stock. We have also done three problem solves on the consignment accounting. In today's session, we are going to learn about consignment accounting and what will be the accounting effect if the goods are invoiced above the cost. Now, what is this? When a consignor sends goods to a consignee and sets any further sales quotes, it is quite possible that the consignee knows the profit which is owned by the consignor. Because when the consignor sends the goods, if the cost of the goods is 100 and the consignor sends the goods at 100 rupees to the consignee, and the consignee saves those goods at 125, then the consignee knows that there is a profit of 25 rupees per piece. So, many times it happens that the consignor does not want to disclose the actual cost to the consignee. Or the consignor never wants to hide the highest profit. If the consignee knows the profit, it is quite possible that the consignee may enter into competition in the future with the consignor. And the consignee may directly purchase the goods from other dealers and sell the goods in turn on an agency basis. So, to avoid this probable competition, the consignor decides to hide the profit. The consignor might send the goods to the consignee at a price which is higher than the cost price. This is known as the invoice price. So, what the consignor does is add some extra profit to the cost and send the goods at the invoice price. For example, if the cost of goods to the consignor is 100 rupees, the consignor might add 20 rupees profit and...

Award-winning PDF software

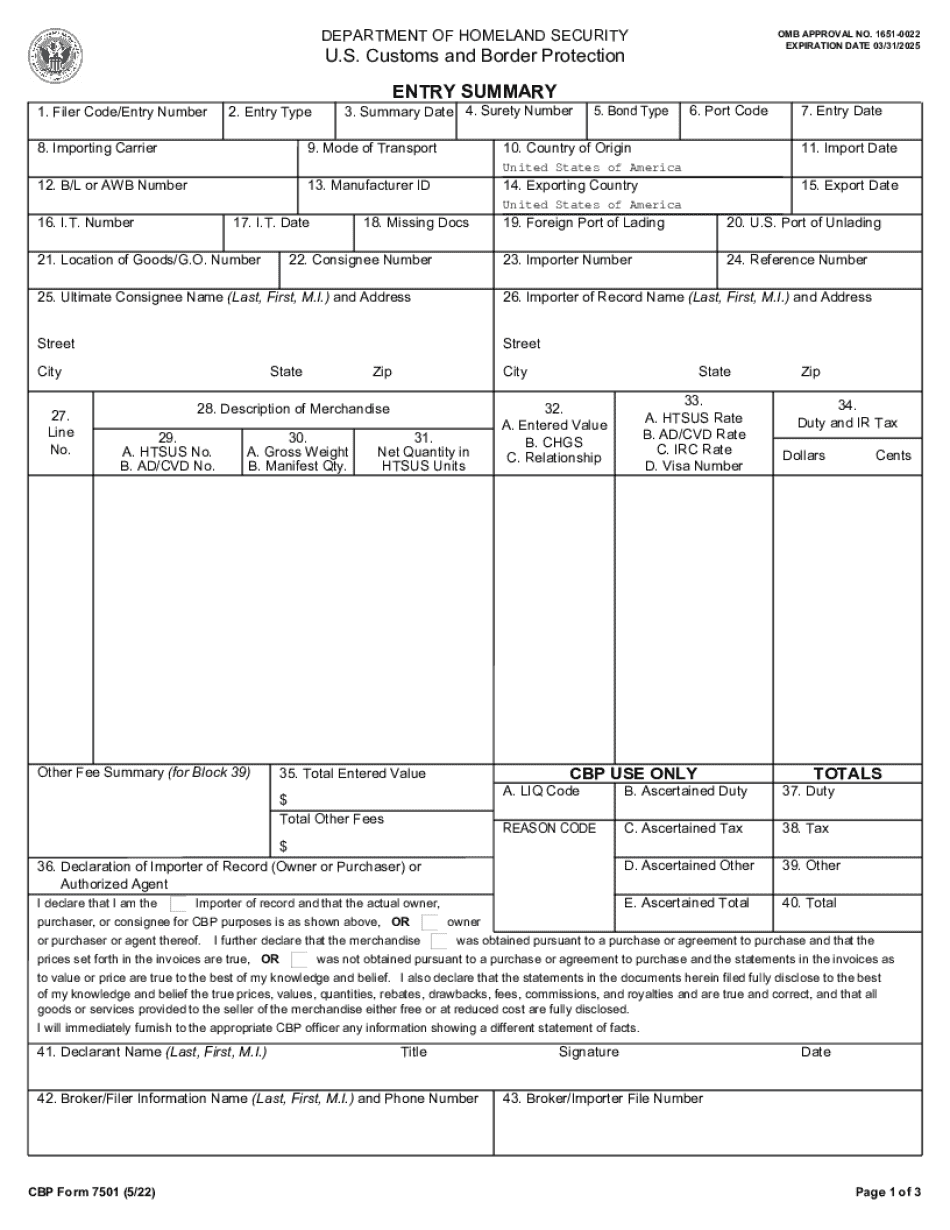

What is a nominal consignee Form: What You Should Know

U.S. Customs and the Customs broker is in place, it is only the duty-duty information that makes the importer report to the collector. It is the customs agent who issues the report that says who is the actual person in the trade. It is also the duty/duty information that determines your duties and tax on the shipment being sold at market value. In cases of an import-export, the customs broker must be a registered individual. It is the duty officer's responsibility to report to duty and tax authorities. The duty officer can request or collect the duty due from the importer or exporter on his/her behalf. A business that makes entry as an agent is also not considered an exporter and does not report to duty. Duty and tax are the responsibility of U.S. Customs and Border Protection (CBP) who must collect the duty. The duties will be the buyer's responsibility. A nominal consignee is also not an import-export, and they do not report to duty. Therefore, they do not have the right to collect or pay duties. The duties are the buyers' responsibility. If you want to be sure that your shipment is the duty-duty information that is in a customs form that your Customs broker sends to CBP as proof of ownership. If the broker isn't reporting the right information with these paperwork forms. Contact them, ask a simple yes or no, to verify the information before you ship the goods. Or they will not be able to sell the shipment, and CBP will do tax assessment and write-off. A nominal consignee is a person who makes entry in his own name for the sole purpose of making entry on the merchandise. He/she does not be in control of the goods, as an agent, and therefore must be a registered individual. The only way the consignee can act as a nominal consignee is if a licensed importer or importer-exporter, who is in the actual business of importing or exporting, uses that agent to make entry on his/her behalf. If you want to be certain that your shipment is the duty-duty information that is in a customs form that your Customs broker sends to CBP as proof of ownership. If the broker isn't reporting the right information with these paperwork forms. Contact them, ask a simple yes or no, to verify the information before you ship the goods.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp Form 7501 Instructions, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp Form 7501 Instructions online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp Form 7501 Instructions by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp Form 7501 Instructions from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is a nominal consignee