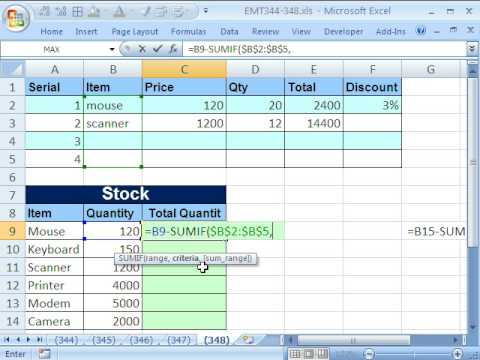

Welcome to Excel magic trick number 348. Hey, if you want to download this workbook and follow along, click on my YouTube channel and click on my College website link, and you can download the workbook Excel magic 344 to 348. This is a little mini version of records for invoices. So, we sold an amount of the particular mouse. The price was 120, and we sold 20 of them. The total was that amount. Now, this is a database with records for invoices and on a separate sheet, you could imagine you could have the stock. This is the running total of inventory units on hand this is the total. Now, I put these things onto the same sheet just to make the video easy but is there a formula we could use? It would always look at our invoice, and I made it real short. You know this database could have thousands of rows. Is there a formula we could put right here that every time we add a new record, it will calculate the running total? Sure there is, how about this? Equals whatever the total is - and we need some way of looking through this whole column finding all of the mouse ones then jumping over to this adding all of those up and subtracting them with the perfect function sum if the range. Now, there's one, two, three arguments, and I've done lots of videos on sum if, but this range right here holds the criteria. This is a specific criteria obviously for the inventory it'll be mouse and then some range that's going to be the inventory that we want to subtract so range this one right here all the way down imagine if it was a thousand rows or whatever and then...

Award-winning PDF software

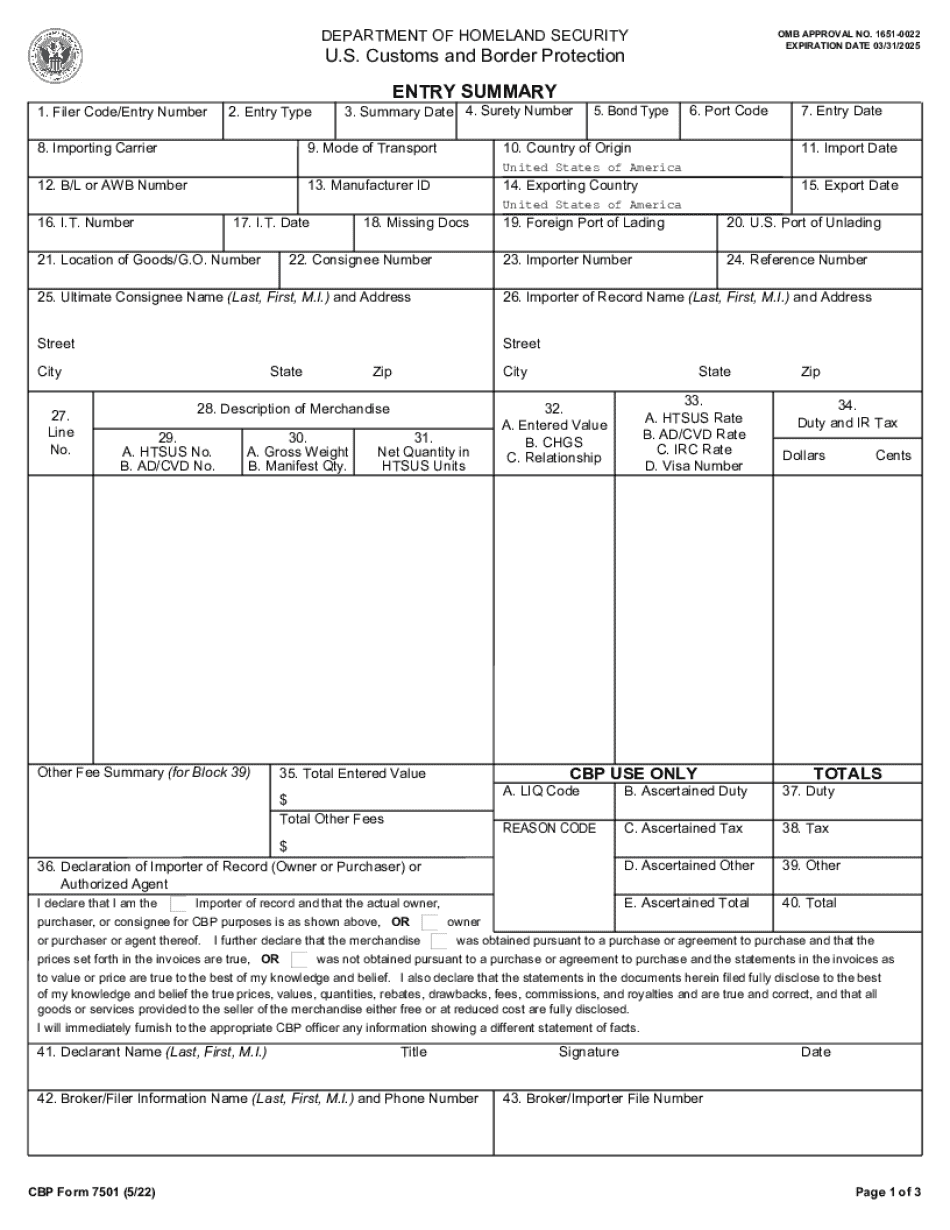

What is a consumption entry Form: What You Should Know

Generally, when goods are imported for use in the United States and going directly into the commerce of the U.S. without 19 CFR Part 142 exporting, they are classified in the first digit. Entry Process — LBS RCS.COM A consumption entry shall be made in the application for an import permit when the import is for use in the national interest, or (i) in connection with transportation operations (e.g., direct export, to a facility for export, shipment within the United States, and/or shipment outside the United States); (ii) in connection with a commercial activity; (iii) in connection with an application under the 19 CFR Part 142 Entry Process — LBS RCS.COM Importing such goods into the United States with a customs value of 500 or more in the first 4 consecutive calendar periods for which they are presented for inspection. This means that it is illegal to transport goods for consumption into the United States over 750. This would make the consumption entry a very high value entry. However, a few goods are subject to this rule as described earlier. The other option is to have the customer ship them to the U.S. Customs offices for inspection. They would be placed in the category of “Exported to the United States, Non-Imported Goods, with a Customs Value of 500 or More”. If you ship them to the USA, you are subject to the above rule. However, this category of entry is limited to exports of 500. A retail business would receive a consumption entry as a result of a customer that has purchased the goods, and sells them at a business location in the United States. However, this is considered an informal and temporary entry, and would not trigger the requirement to obtain a permanent import permit. The “A” consumption entry is a high value entry. If the customer is exporting the goods, they are still considered a customs value, and will trigger the requirement to obtain import permits. CBP Form 7501: A Consumption Entry CBP Form 7501: Entry Summary May 24, 2024 — Customs and Border Protection relies upon CBP Form 7501 entry Summary to determine relevant information (e.g. entry summary.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp Form 7501 Instructions, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp Form 7501 Instructions online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp Form 7501 Instructions by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp Form 7501 Instructions from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is a consumption entry