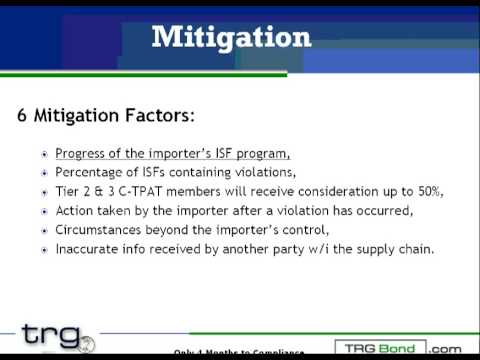

Are those penalties? The fact is, those penalties can be as severe as anything that can be imposed from CBP. Because there's very little mitigation to be able to avoid them, there are basically four factors that can result in liquidated damages. The first one is failure to submit, pretty straightforward - you got to file your ISF. Now, we can make this a little bit more ominous for you. If you don't file your ISF and those goods hit the shore, the best thing you could hope for is that customs doesn't allow them to be unladen. The worst thing is that they go geo and end up at an Indiana Jones warehouse that's 3,000 by 5,000, and you'll never see your goods again. So, they are quite serious, and think again, this is a security filing, so this is set up to secure the borders of the United States. That's why they're being very harsh, so you must file your ISF. The days of learning about your order or your import when you get your arrival notice are over. The days of the CEO or your purchasing agent just grabbing a deal, buying it, and setting it in motion without your knowledge are over. We're going to talk a little bit more about discussions within your organization if you haven't set those up already for policies and procedures. It is very important that you know in import and logistics what's going on out of purchasing and sales. The second one is a late submission. Late submissions are going to be determined through that bill of lading match because they're going to know if, in fact, you filed it in time. There's a progress report that will show you a little bit later that will give you information on...

Award-winning PDF software

Us customs bond lookup Form: What You Should Know

All other copies must have the signature of the Bond Team Representative. Failure or refusal to provide the necessary bond copies will invalidate all existing bonds and be a violation of Title 16, USC, Section 3.12(i) and (j). (i) No bond may be filed against any person for the following: (A) Failure to obey the order to produce documents; (B) Making statements which are false or misleading; (C) Failure to timely make payments; or (D) The unauthorized use of any agency letter of credit. (ii) No bond may be filed against any person for any person other than the bond administrator. The bond administrator must be present in order to act. (iii) A person may withdraw a bond at any time. The bond administrator must notify the Bond Manager that it wants to withdraw the bond prior to filing. All payments made on a withdrawn bond must be made directly to the bond manager. The bond manager must keep the bond payments separate from any other payments and mail them to the bond manager within ten days from the date of the withdrawal, otherwise the withdrawal may not be processed. For the bond process to be successful, it will be important that the parties to the bond transaction understand and comply with the process for withdrawal of the bond. Therefore, the bond process is administered by the Administrative Law Judge (ALJ) before the Bond Manager has received notice of the withdrawal by the bond administrator. The ALJ will determine whether the withdrawal would be appropriate and will also determine the amount of all existing bonds due. Effective January 2, 2017; the Secretary of Homeland Security has modified the current bond regulations. All documents filed with CBP using the new regulations must contain a certification showing that they have been prepared using the new bond regulations, or a copy of the current regulations. USPS Bond Form 3 — OLD Conference Room Request Form: (Filing fee 60.00) Search by Name or the Form Number: (Filing fee 50.00) CBP Forms | U.S. Customs and Border Protection Search by Document Type: (Filing fee 50.

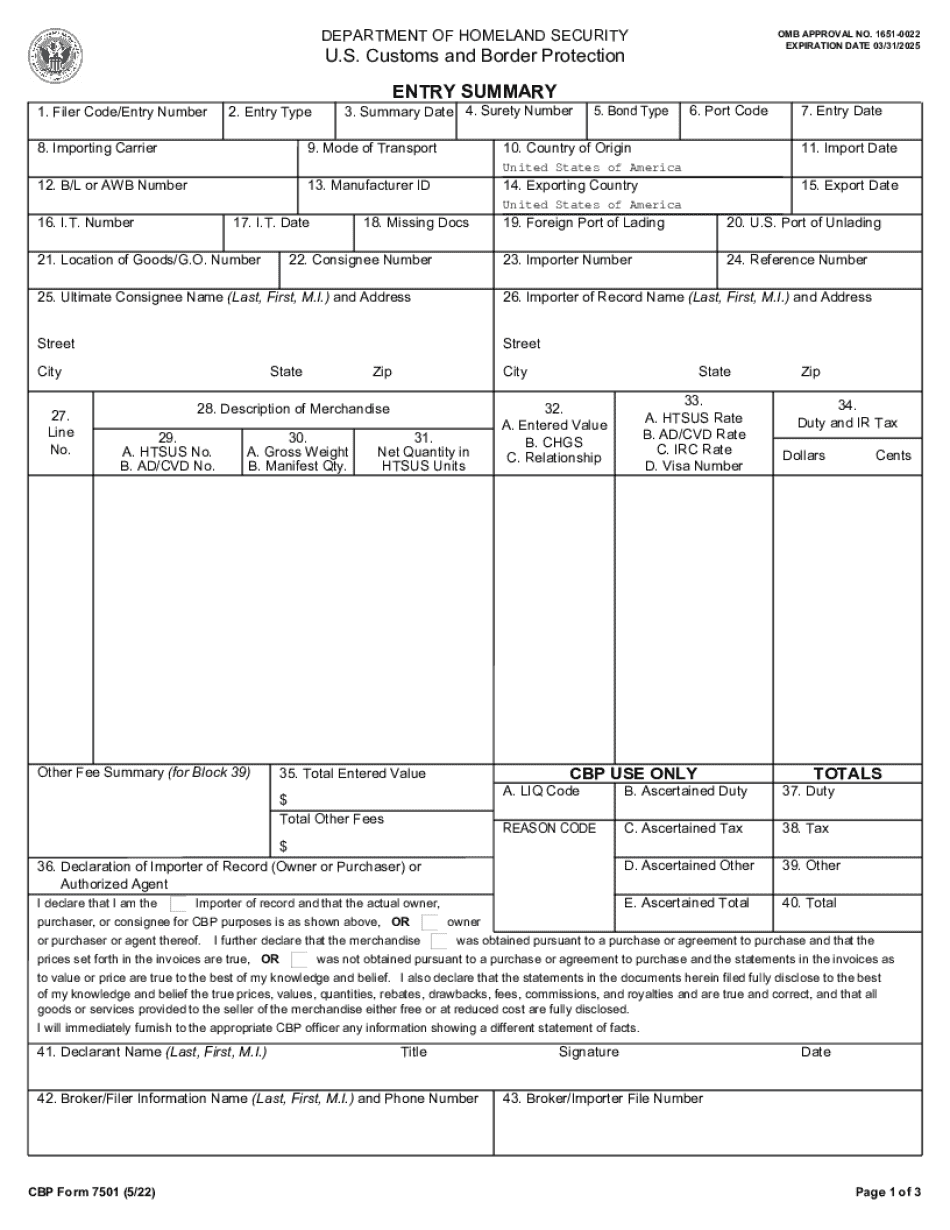

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Cbp Form 7501 Instructions, steer clear of blunders along with furnish it in a timely manner:

How to complete any Cbp Form 7501 Instructions online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Cbp Form 7501 Instructions by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Cbp Form 7501 Instructions from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Us customs bond lookup